rfm模型分析與客戶細分

With some free time at hand in the midst of COVID-19 pandemic, I decided to do pro bono consulting work. I was helping a few e-commerce companies with analyzing their customer data. A common theme I encountered during this work was that the companies were more interested in getting a list of their best customers so they could run some marketing campaign to boost their revenue. My recommendation has always been that every customer segment has some valuable insight to offer and that best customers depend on the immediate company goal/objective at hand. In other words, best customers are not always what we call the high-value customers. In this article, I will highlight various insights RFM segmentation can provide.

在COVID-19大流行期間有一些空閑時間,我決定進行無償咨詢工作。 我曾幫助一些電子商務公司分析其客戶數據。 我在這項工作中遇到的一個共同主題是,這些公司對獲取最佳客戶名單更感興趣,因此他們可以開展一些營銷活動來增加收入。 我的建議一直是,每個客戶群都應提供一些有價值的見解,并且最好的客戶取決于當前的公司目標。 換句話說,最佳客戶并不總是我們所謂的高價值客戶。 在本文中,我將重點介紹RFM細分可以提供的各種見解。

使用RFM分析進行細分 (Segmentation using RFM Analysis)

Analysis based on RFM — stands for Recency, Frequency and Monetary — is probably one of the easiest ways to segment the customers given companies usually have the customer purchase information readily available to them.

鑒于公司通常都容易獲得客戶購買信息,因此基于RFM的分析(代表新近度,頻率和貨幣)可能是細分客戶的最簡單方法之一。

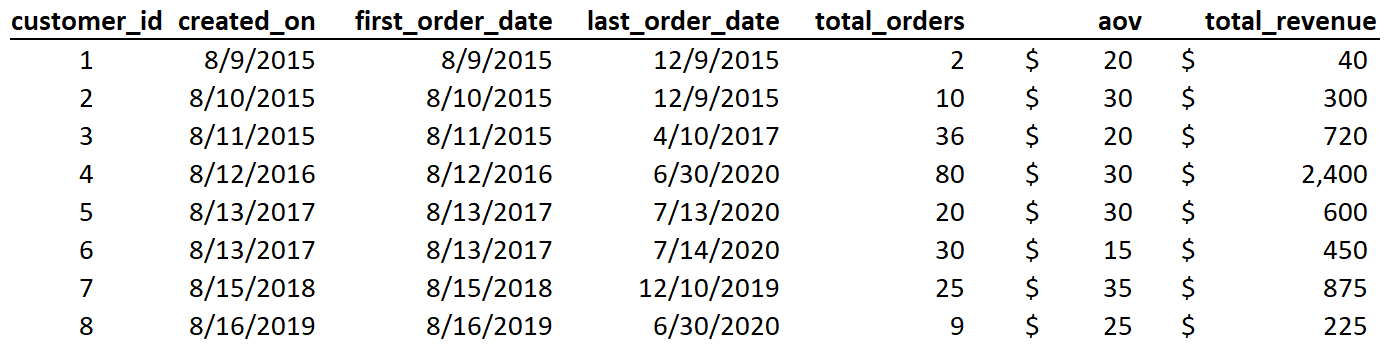

Here is a sample customer purchase history data that is needed for the RFM analysis. With this, each customer is scored on the RFM attributes on a scale of 1–5 (or 1–4 or 1–3, depending on how granular you want to look at the purchase behavior) with 1 being the least and 5 being the best score.

這是RFM分析所需的樣本客戶購買歷史記錄數據。 這樣一來,每位客戶在RFM屬性上的評分為1-5(或1-4或1-3,具體取決于您希望如何看待購買行為),其中1最小,5最小。最好成績。

For example, a customer with a most recent purchase will have a score of 5 on Recency, whereas a customer who hasn’t purchased in a while will have a score of 1.

例如,最近購物的客戶在Recency上的得分為5,而一段時間內沒有購物的客戶的得分為1。

Here the important thing to note is that the criteria for scoring varies business by business and by understanding customer purchase cycles, we can come up with the scoring criteria. For this sample data, I used the following recency scoring based on 2-month purchase periods. Once you score on all three attributes, we can create RFM score (sum of these three scores) and RFM Category (when R=4, F=3, M=4, RFM Category = 434). You might have seen cases where RFM score was used to segment customers. This method has some serious pitfalls and its better to use the RFM category instead.

這里要注意的重要一點是,評分標準因企業而異,并且通過了解客戶購買周期,我們可以提出評分標準。 對于此樣本數據,我基于2個月的購買期使用了以下新近度評分。 在所有三個屬性上得分后,我們可以創建RFM得分(這三個得分的總和)和RFM類別(當R = 4,F = 3,M = 4,RFM類別= 434時)。 您可能已經看到過使用RFM分數細分客戶的情況。 此方法有一些嚴重的陷阱,最好使用RFM類別。

Using a 5 point scale could lead up to 125 RFM categories. Next step is to group these RFM categories into various segments. While the standard RFM analysis doesn’t take into account other data points such as length of the relationship of a customer, but this is the time to look at the purchase data holistically and assign segments to the RFM categories. For example, a customer with long relationship with the business, most recent purchases but low monetary might have used promotional offers more frequently than a customer with similar recency, monetary but less frequent and shorter relationship with us. One could be segmented into Deal Seeker and the other one could be segmented into Newcomers.

使用5分制可能會導致多達125個RFM類別。 下一步是將這些RFM類別分為不同的細分。 盡管標準的RFM分析未考慮其他數據點,例如客戶關系的長度,但這是時候全面查看購買數據并將細分分配給RFM類別的時候了。 例如,與企業有長期關系,最近購買但貨幣較少的客戶可能比具有類似新近度,貨幣但頻率較低,與我們關系較短的客戶更頻繁地使用促銷優惠。 一個可以細分為Deal Seeker ,另一個可以細分為Newcomers 。

In the above example, I have identified 6 segments with uniquely distinguishable purchase behaviors.

在上面的示例中,我確定了6個具有獨特可區分購買行為的細分。

Dropouts: In other words these are the lost customers. They became our customers through initial promotional offer and either didn’t come back or made 1–2 subsequent purchases.

輟學:換句話說,這些是失去的客戶。 他們通過最初的促銷活動成為我們的客戶,要么沒有回來,要么隨后進行了1-2次購買。

Early Enthusiasts: These customers were with the company for a relatively longer period of time than Dropouts and made frequent purchases and spent lot of money. However, they were lost along the way. These will be the best customers if the objective is to reactivate the lost customers.

早期發燒友:與Dropouts相比,這些客戶在公司呆的時間相對較長,并且經常購買商品并花了很多錢。 但是,他們一路迷路了。 如果目標是重新激活失去的客戶,這些將是最好的客戶。

Newcomers: As the name suggests, this segment consists of customers who are relatively new and active. Any marketing efforts for this segment could be to promote them to loyalty programs or offer promotions to try other products.

新移民:顧名思義,該細分市場由相對較新且活躍的客戶組成。 此細分市場的任何營銷工作可能是將其推廣到會員計劃或提供促銷以嘗試其他產品。

Deal Seekers: These customers have relatively long relationship with the company and are currently active. They are interested in making frequent purchases but usually on look out for promotional offers. These will be the best customers if running a campaign to boost sales.

尋求交易者:這些客戶與公司的關系相對較長,并且目前處于活躍狀態。 他們有興趣頻繁購買商品,但通常會尋找促銷優惠。 如果開展宣傳活動以提高銷量,這些將是最好的客戶。

Potential High Value Customers: These are relatively newer customers compared to Deal Seekers but are less sensitive to the price or are less keen on promotional offers. In shorter period of time, they made frequent purchases and spent lot of money with the company. Nudge them towards High Value Customers and sign them up for loyalty program.

潛在的高價值客戶:與“尋求交易者”相比,這些客戶相對較新,但對價格不太敏感或對促銷活動不感興趣。 在較短的時間內,他們經常購買商品,并在公司花了很多錢。 將他們推向高價值客戶,并簽署他們的會員計劃。

High-Value Customers: These are the most loyal customers. They are active with frequent purchases and high monetary value. They could be the brand evangelists and should focus on serving them well. They could be the best customers to get feedback on any new product launches or be the early adopters or promoters.

高價值客戶:這些是最忠誠的客戶。 他們很活躍,經常購買并且具有很高的貨幣價值。 他們可能是品牌傳播者,應該專注于為他們提供良好的服務。 他們可能是獲得任何新產品發布反饋的最佳客戶,或者是早期采用者或推廣者。

從可視化中獲取見解 (Getting Insights from Visualization)

Once the customer segments have been identified using RFM analysis, it is always a good idea to visualize these segments not only for a sanity check but also to derive actionable insights. I used Tableau to visualize the segments.

一旦使用RFM分析確定了客戶群,將這些細分形象化以進行健全性檢查并獲得可行的見解始終是一個好主意。 我使用Tableau可視化了細分。

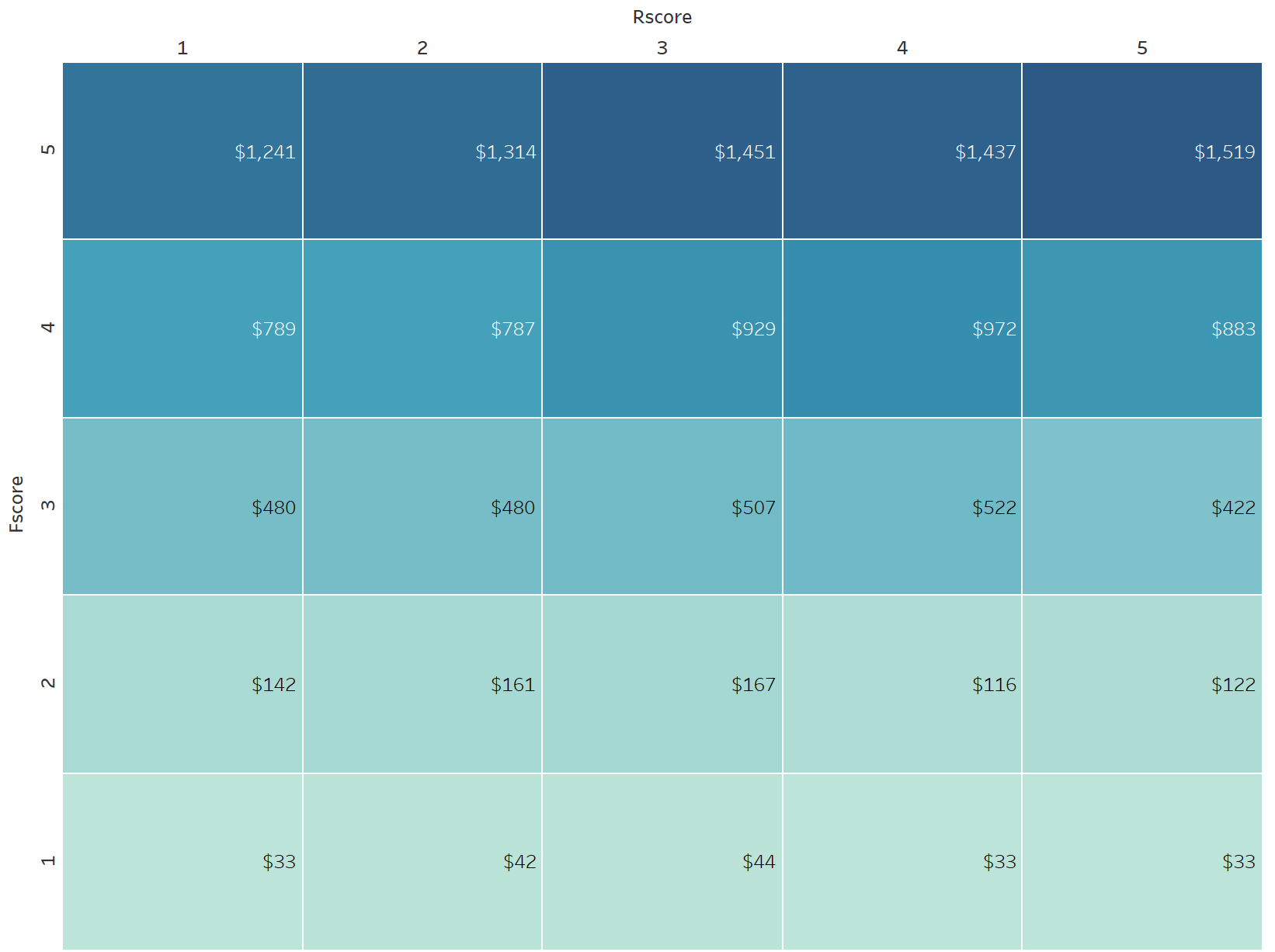

Recency and Frequency score matrix chart is usually a good one for sanity check. As R score and F score increase, the monetary value increases. Higher R score may not necessarily lead to higher monetary value given that the business may have acquired new customers recently.

新近度和頻率得分矩陣圖通常是進行健全性檢查的好方法。 隨著R分數和F分數增加,貨幣價值增加。 鑒于企業最近可能獲得了新客戶,因此較高的R分數不一定會導致較高的貨幣價值。

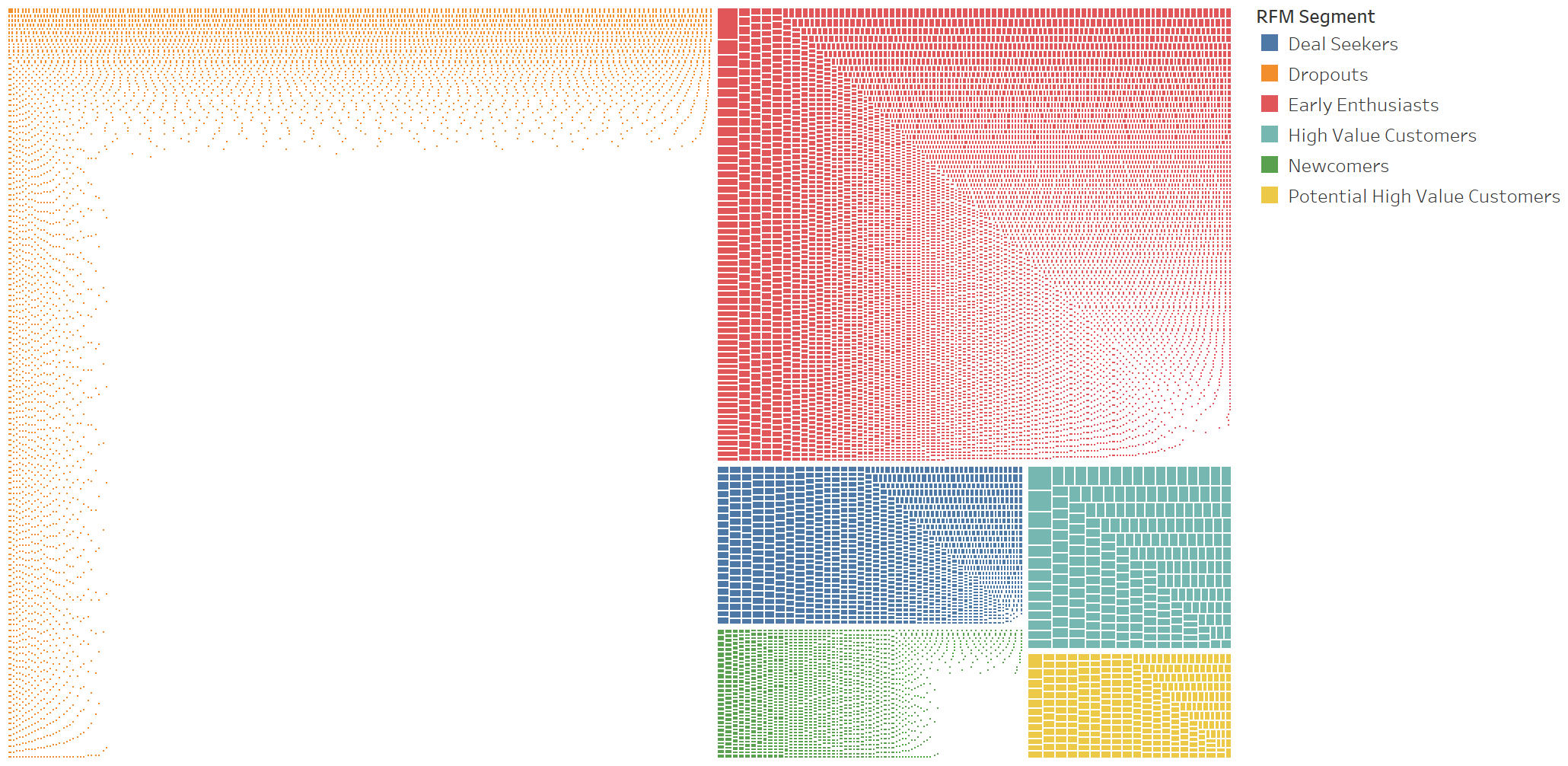

The treemap shows how each customer segment is contributing to the total revenue and how much each customer within a given segment is contributing to the total revenue. In a way, this helps predict how consistent revenues will be given how many customers have churned and how active other segments are.

樹狀圖顯示了每個客戶群如何為總收入做出貢獻,以及給定細分市場中的每個客戶為總收入做出了多少貢獻。 從某種意義上說,這有助于預測將有多少客戶流失以及其他細分市場的活躍程度如何帶來穩定的收入。

When there is geographic information for the customers, plotting them on a map will give some unique insights. One of the interesting cases I have seen is for an e-commerce company with some retail presence. Mapping the customer geographic data helped explain clusters of online shoppers around geographies where the company has retail store presence. Interestingly enough, these clusters of online customers were acquired organically. Accordingly, you can evaluate strategies to expand retail presence that could potentially boost e-commerce business.

當有客戶的地理信息時,將其繪制在地圖上將提供一些獨特的見解。 我所看到的一個有趣的案例是一家擁有零售業務的電子商務公司。 映射客戶地理數據有助于解釋公司在零售商店中存在的地理位置周圍的在線購物者群體。 有趣的是,這些在線客戶群是有機收購的。 因此,您可以評估策略來擴展零售業務,這可能會促進電子商務業務。

Another thing is the channel performance. Customer segmentation helps with understanding channel performance better. By looking at customer lifetime value (LTV) per segment and what portion of each segment is attributable to a channel, acquisition cost associated with that channel, we can evaluate channel performance more accurately than without segmentation.

另一件事是頻道性能。 客戶細分有助于更好地了解渠道績效。 通過查看每個細分的客戶生命周期價值(LTV)以及每個細分的哪個部分可歸因于某個渠道以及與該渠道相關的購置成本,我們可以比不進行細分來更準確地評估渠道效果。

結論 (In Conclusion)

Usually, startups tend to be growth focused rather than retention focused. Even though they are resource constrained, startups are better off investing some of their limited resources on understanding their existing customers so they can device effective retention strategies that could, in turn, help them with acquiring new customers. After all, it may end up being much cheaper to retain your existing customer than to acquire a new one. Word of mouth is still a major customer acquisition channel and you want your customers to be the evangelists for your product.

通常,初創公司往往注重增長而不是保留。 盡管他們受到資源的限制,但初創公司最好將一些有限的資源用于了解他們的現有客戶,以便他們可以制定有效的保留策略,從而幫助他們獲得新客戶。 畢竟,保留您的現有客戶可能比購買新客戶便宜得多。 口耳相傳仍然是主要的客戶獲取渠道,您希望您的客戶成為產品的傳播者。

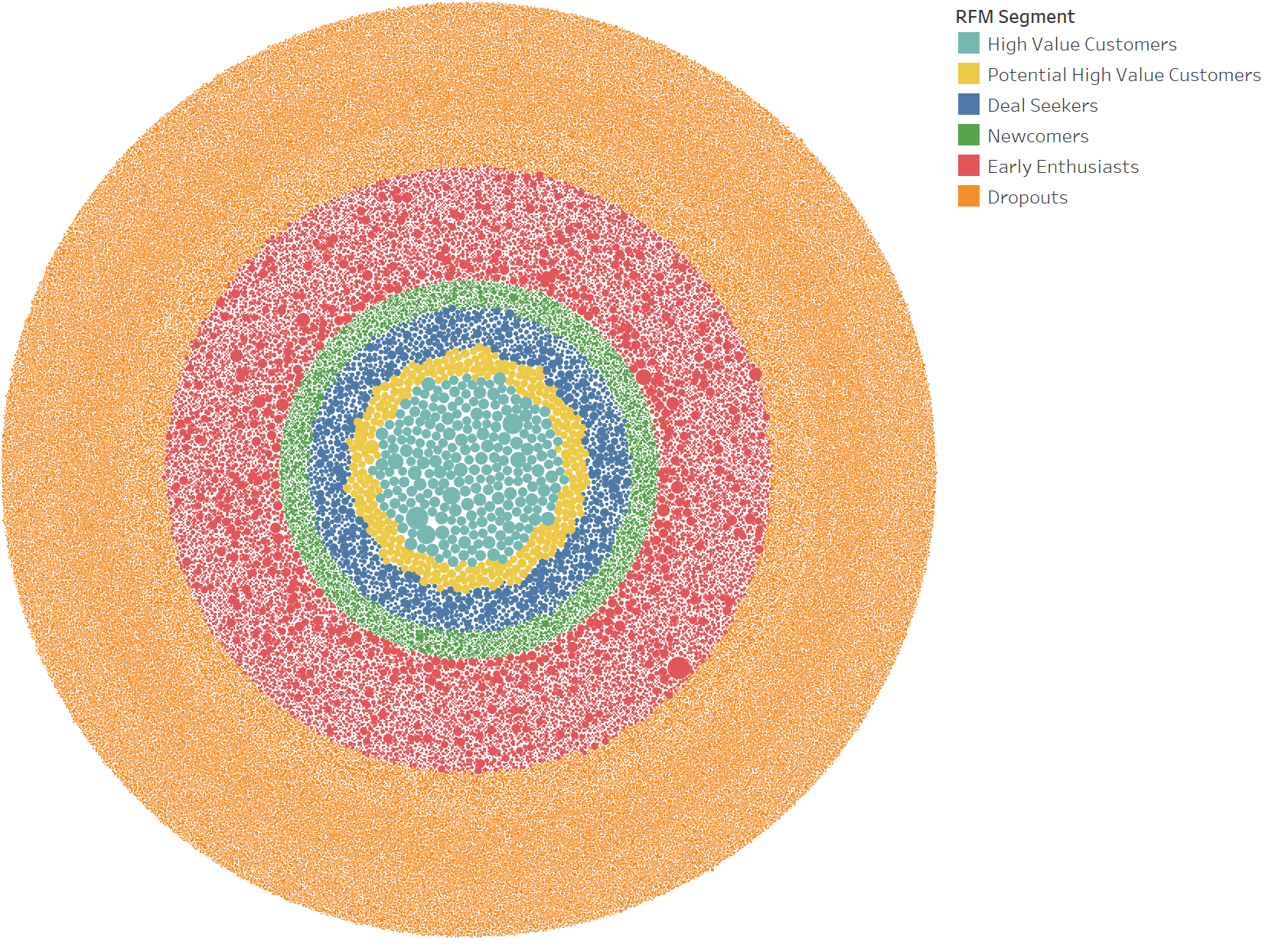

Reiterating the quest for the best customers, it may seem obvious that high-value customers are the best customers. When there is a goal at hand — say to run a marketing campaign to boost revenue — we should dig a little deeper to find out who the best customer would be for that specific goal or which customer segment is at the bullseye.

重申對最佳客戶的追求,高價值客戶顯然是最佳客戶。 當有目標時(例如,開展營銷活動以增加收入),我們應該進行更深入的研究,以找出誰是實現該特定目標的最佳客戶,或者哪個客戶群處于靶心位置。

翻譯自: https://towardsdatascience.com/how-to-identify-the-best-customers-using-rfm-based-segmentation-a0a16c34a859

rfm模型分析與客戶細分

本文來自互聯網用戶投稿,該文觀點僅代表作者本人,不代表本站立場。本站僅提供信息存儲空間服務,不擁有所有權,不承擔相關法律責任。 如若轉載,請注明出處:http://www.pswp.cn/news/391420.shtml 繁體地址,請注明出處:http://hk.pswp.cn/news/391420.shtml 英文地址,請注明出處:http://en.pswp.cn/news/391420.shtml

如若內容造成侵權/違法違規/事實不符,請聯系多彩編程網進行投訴反饋email:809451989@qq.com,一經查實,立即刪除!)

CSDN篇)

獲取易于閱讀的JSON樹)

)

)

)

)